Dealing with unpaid debts can be incredibly stressful, both for individuals and businesses. This is where Debt Recovery Companies come into play. These companies specialize in recovering outstanding payments, acting as a third party between you and your debtor. But what exactly do they do, and when should you consider enlisting their help?

What are Debt Recovery Companies?

Debt recovery companies, sometimes referred to as debt collection agencies, work on behalf of businesses or individuals to recover money owed to them. These debts could stem from unpaid invoices, loans, or other agreements where payment is overdue.

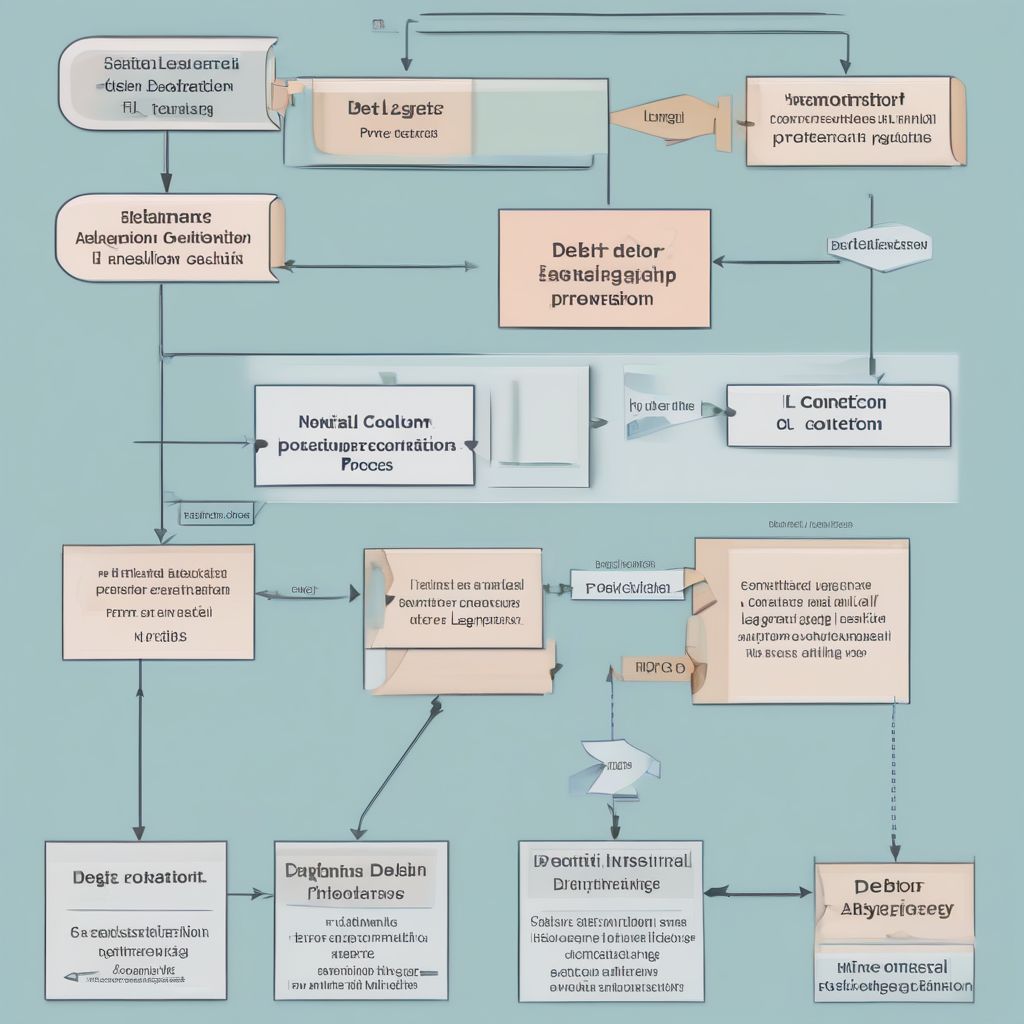

Debt Collection Process

Debt Collection Process

Why Might You Need a Debt Recovery Company?

There are several reasons why you might consider engaging a debt recovery company:

- You’ve been unsuccessful in collecting the debt yourself. Sometimes, despite your best efforts, debtors simply won’t pay.

- The debt is significantly impacting your cash flow. Unpaid invoices can seriously hamper your business operations.

- You want to avoid the stress and time commitment of debt collection. Chasing payments can be time-consuming and emotionally draining.

How Do Debt Recovery Companies Work?

Debt recovery companies typically employ a multi-stage approach:

- Initial Contact: The company will contact your debtor, informing them of the outstanding debt and outlining payment options.

- Negotiation: They will negotiate with the debtor to reach a mutually agreeable payment plan.

- Legal Action: In some cases, if negotiations fail, the debt recovery company may recommend pursuing legal action to recover the debt.

Choosing the Right Debt Recovery Company

Selecting the right debt recovery company is crucial. Here are some factors to consider:

- Reputation: Look for companies with a proven track record of success and positive client testimonials.

- Fees: Understand the fee structure. Some companies charge a percentage of the recovered debt, while others have fixed fees.

- Transparency: Choose a company that is transparent about its methods and keeps you informed throughout the process.

FAQs about Debt Recovery Companies

Q: Will hiring a debt recovery company harm my relationship with my customer?

A: While there’s always a risk, reputable debt recovery companies prioritize ethical and professional communication. Their aim is to recover the debt while preserving your business relationships where possible.

Q: How much does it cost to use a debt recovery company?

A: Fees vary depending on the company and the complexity of the debt. Be sure to clarify the fee structure upfront.

Q: Do I need a lawyer to use a debt recovery company?

A: In many cases, no. Debt recovery companies have in-house legal expertise. However, legal advice may be necessary if the case goes to court.

Conclusion

Dealing with unpaid debts is a challenging aspect of doing business. Debt recovery companies can alleviate the stress and complexity of the process, helping you recover your money and focus on running your business. By understanding your options and choosing the right partner, you can navigate this challenging situation effectively.